Bamboocloud Solutions

-

Background

With the rapid adoption of 5G, big data, and AI across the financial sector, digital transformation in finance is now an industry imperative. The demand for online and intelligent financial services has never been greater. Financial institutions are accelerating their digital journey, recognizing that success depends not just on data, but on building secure, efficient digital platforms that seamlessly connect systems and unlock data value for their clients.

-

Value

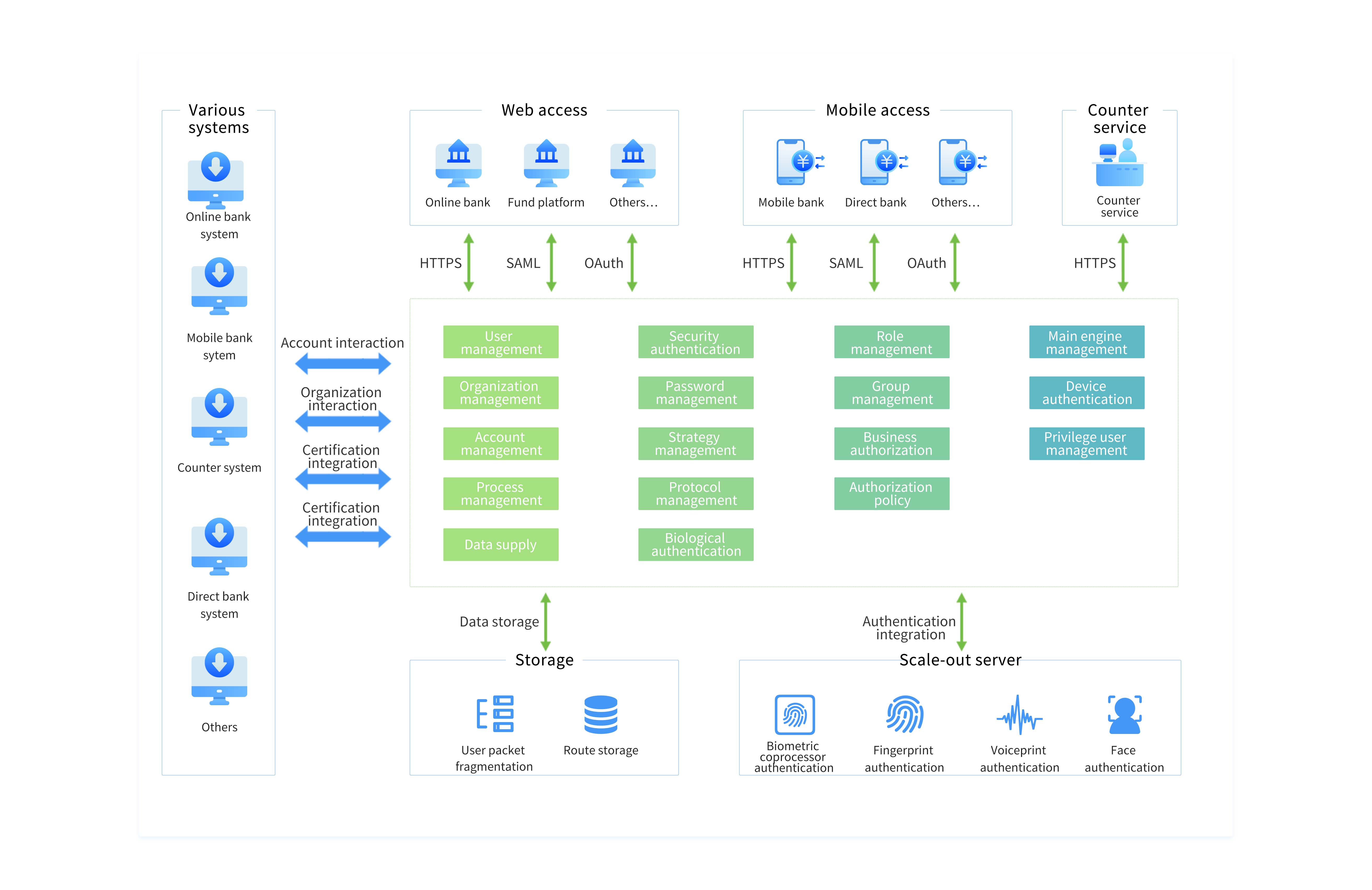

The Bamboocloud intelligent identity governance platform leverages AI, big data, and other emerging technologies to deliver seamless integration across offline, mobile, online, and cloud environments. By aggregating and managing identity data from multiple sources, we create unified digital identity profiles, empowering financial institutions to innovate, streamline processes, and accelerate business transformation.

-

Solution

The Bamboocloud intelligent identity governance platform strengthens internal controls for financial institutions, addressing the specific needs of financial IT and business infrastructure. We focus on end-to-end identity governance—centralizing access control, standardizing management workflows, and supporting critical business processes through top-level solution design. Our platform delivers comprehensive identity and access management (IAM) for all user types and business scenarios. -

Customer Case

Bamboocloud partners with leading financial organizations—including China Merchants Bank, Xinjiang Rural Credit Cooperative, Kunlun Bank, and Toyota Financial—to power their digital transformation with intelligent identity governance platforms.

Key Challenges in the Financial Industry

-

Rising Internet Finance Development & Industry Competition

01/Financial habits and transactions are evolving rapidly. New financial services and non-bank institutions are growing quickly. Banks are transforming into comprehensive financial service providers with diversified channels, digital sales networks, and disintermediation in financing, lending, and payments. The industry faces intense competition, and efficient, secure IT infrastructure has become mission critical. -

Regulatory Compliance

02/In May 2018, the China Banking and Insurance Regulatory Commission issued the Notice on Strengthening Security Risk Control of Production and Transaction Systems of Banking Financial Institutions,—requiring thorough risk assessments, remediation of security weaknesses, and robust measures for identity authentication and access control to defend against system spoofing and unauthorized access.

-

Insufficient Internal Controls & Compliance

03/1. Lack of tiered management for internal staff, outsourced users, application accounts, shared accounts, and system accounts

2. Absence of periodic review mechanisms

3. No unified audit of user access logs, including timestamps, locations, server IPs, and access methods

4. Limited compliance in permission management -

Risk Management Gaps

04/1. Internal risk management is often overlooked

2. No anomaly detection for login and access behaviors

3. No automated response measures for abnormal access activities

How IAM Solves These Challenges

Bamboocloud's intelligent identity governance platform reinforces internal controls and supports IT integration in the financial sector. Designed with a focus on business-driven identity management, our solution centralizes access authorization and governance, ensures compliance, supports key business functions, and scales across all user categories and operational scenarios.

Value

-

Automated User Lifecycle Management

Automate the entire lifecycle of internal and external users, streamlining digital identity administration across all IT systems. -

Enhanced Productivity

Improve user login experience and efficiency, boosting workforce productivity and customer satisfaction. -

Regulatory & Audit Readiness

Ensure compliance with audit requirements, increase audit efficiency, and strengthen risk prevention. -

Intelligent Risk Analysis

Real-time analysis of user access behavior enables proactive alerts, ongoing controls, and forensic traceability—delivering intelligent, identity-driven risk services.

Integrated Applications